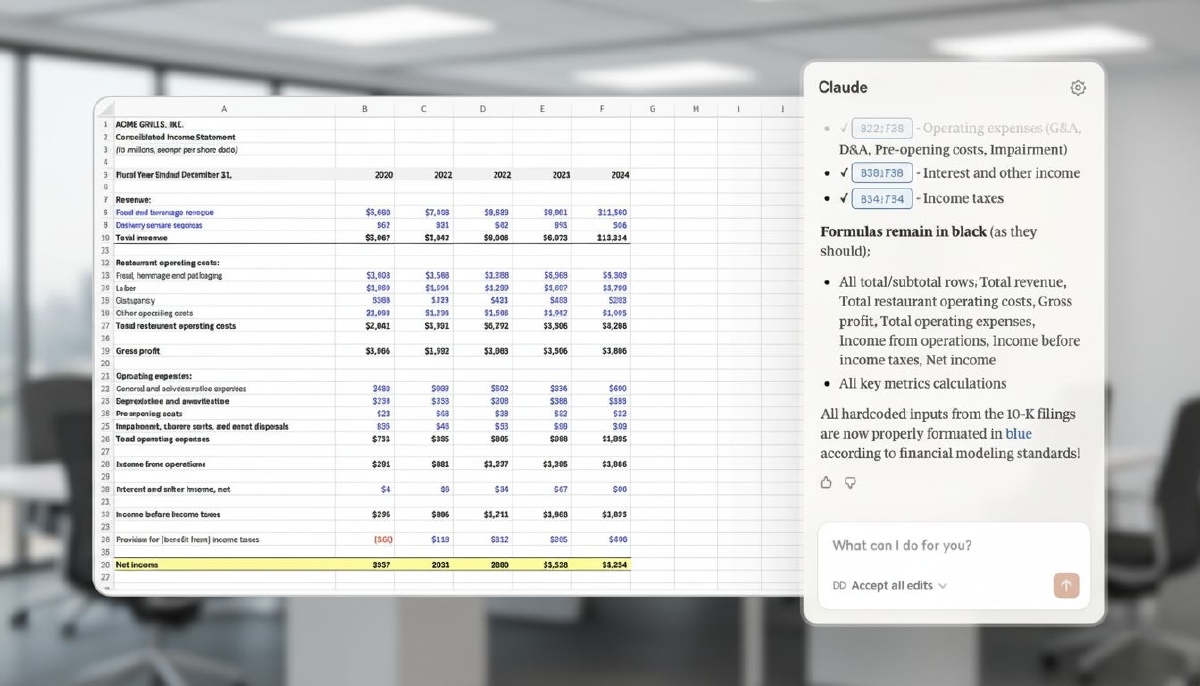

Anthropic just announced a partnership with the London Stock Exchange Group (LSEG) to embed comprehensive financial market data directly into Claude. This means financial professionals can now use Claude to automatically summarize earnings calls, sift through due diligence documents, and identify market signals—all while working within an enterprise-grade security framework.

It’s a significant move. LSEG’s data is vast: market analytics, research, news, and real-time pricing across global exchanges. Integrating that into an AI assistant transforms how analysts and traders might access and process information. Instead of manually combing through hundreds of pages of reports, you ask Claude a question and get a synthesized answer backed by institutional-grade data.

Speed vs. Judgment#

The promise is clear: faster analysis, fewer manual hours, and more time for strategic thinking. AI excels at processing volume—scanning thousands of documents, spotting patterns, and surfacing relevant details that humans might miss under time pressure.

But here’s the consideration: financial markets aren’t just about speed. They’re about judgment, context, and understanding what numbers mean in a broader economic or geopolitical landscape. Claude can summarize an earnings call, but it doesn’t understand market sentiment the way a seasoned analyst does. It can flag signals, but interpreting why a signal matters requires experience that AI doesn’t yet possess.

What This Means#

Anthropic is positioning Claude as a productivity multiplier for finance—a tool that handles the heavy lifting so humans can focus on decisions. That’s the right framing. But as AI becomes more embedded in high-stakes industries like finance, the critical question isn’t whether it’s useful—it obviously is—it’s whether professionals will maintain oversight or start deferring to AI outputs by default.

The partnership is impressive. The execution will depend on whether financial institutions use Claude as a co-pilot or start treating it as the autopilot.

Learn more: Visit Anthropic’s official announcement or explore LSEG.